$LKYRF’s Mojave Land Grab Makes Them a National Contender

- Checkers

- Sep 16, 2025

- 3 min read

Since we covered Locksley Resources (ASX: $LKY, OTCQB: $LKYRF, FSE: X5L) just over a week ago, the junior miner has seen its share price climb from 0.15 to 0.34 amid the release of a slew of updates that showed the world they mean business. Located in the Mojave Desert right next door to the same property that the U.S. government invested over $400 million in developing, we are watching a cross-listed junior slowly but surely race towards solving one of the nation’s largest problems: dependence on foreign sources for critical mineral production and refinement.

China still controls about 85% of global rare earth processing and around 60% of global antimony supply. The United States produces none of its own antimony, leaving entire industries dependent on foreign supply. These are the materials that underpin F-35 fighter jets, EV motors, missile guidance systems, and the power grid, and Washington has responded with Defense Production Act funding to rebuild the nation’s mineral base. Antimony demand alone is projected to grow about 6% annually through 2030, and the global market is expected to rise from roughly 2 billion today to 3.5 billion. The Mojave has quickly become the frontline of that effort.

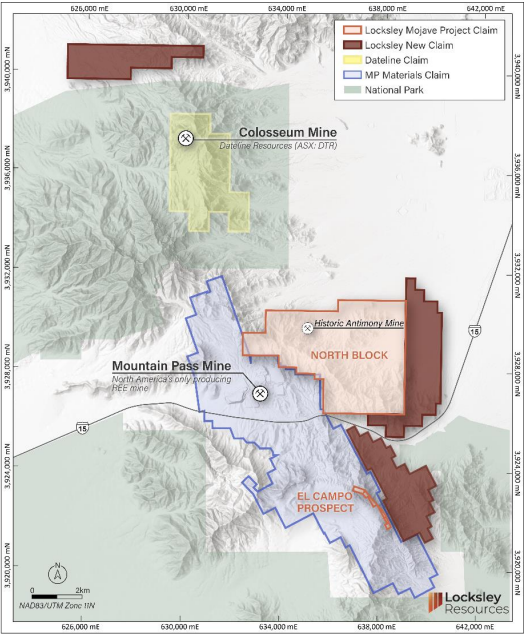

LKYRF expanded its position there by staking 249 new claims, bringing its total to 491 and pushing its footprint to more than 40 square kilometers. The new ground directly adjoins MP Materials’ Mountain Pass property, while a second block lies about three kilometers north and along strike of Dateline Resources’ Colosseum Mine. Administrative filings are underway, and field crews are preparing stream-sediment and rock-chip sampling programs set to begin in Q4. Permitting is being fast-tracked so the company can move quickly from early surveys into targeted drilling across the corridor.

Exploration crews have identified a new target named the Hendricks Prospect within the northern block of the Mojave Project, where mapping uncovered the remnants of substantial historical workings including a collapsed headframe, waste dumps, and a vertical shaft estimated to extend more than 15 meters underground. The shaft is aligned along NNE-striking veins that mirror the structures seen at the Desert Antimony Mine, and grab samples from surface have been submitted for laboratory analysis to determine what was historically mined, with results to be folded into follow-up mapping, sampling, and targeting work across the newly consolidated land package.

LKYRF has also entered an agreement with EV Resources (ASX: $EVR) to work towards EVR supplying antimony concentrate for DeepSolv, the proprietary low-temperature refining technology under development with Rice University. The arrangement includes a planned A$0.75 million strategic investment by LKYRF and gives the company priority access to EVR’s Los Lirios samples for scale-up testwork. DeepSolv has already demonstrated recovery rates above 95% while operating at far lower temperatures than the 1,200°C smelting typically used, and it eliminates the toxic reagents that have historically made antimony processing nearly impossible to permit in North America.

LKYRF currently has a market cap of just over $84 million, compared to MP Materials at $11 billion, even though their properties sit side by side in the same Pentagon-backed corridor. The company has quietly built a 40-square-kilometer land position brimming with high-grade antimony and rare earth targets, and the pieces are now being set in motion. Drilling targets are being lined up, permitting is accelerating, and DeepSolv test runs are advancing at Rice University while field crews comb new ground for additional deposits. In other words: what was once a low-key cross-listed junior is now emerging as the potential cornerstone of America’s critical minerals rebuild, positioned to stand alongside the sector’s giants.

Disclaimer: Mt. Zion Market Ventures has received compensation for the creation and dissemination of this article. For more information, please visit opendisclose.com. The information provided here is not intended to be a comprehensive analysis of the subjects mentioned. All information, opinions, and forecasts contained herein should not be construed as investment advice, a recommendation, or an offer to buy or sell any securities or related financial instruments. Investors should conduct their own research or consult with a qualified financial advisor before making any investment decisions. The author and publisher of this content are not responsible for any losses, damages, or other consequences that may result from the use of the information provided. Investing in stocks, including those mentioned here, involves risks, including the risk of loss.